Why choose First Community Bank Mortgage Lenders?

We're a local bank with local solutions. We empower every homebuyer with clarity, confidence, and expertise, delivering clear mortgage solutions that fit your life, not just your loan.

Turn your home dreams into a reality.

Are you ready to finance the house of your dreams? Whether you’re a first time-home buyer or just looking to upgrade, we can help you find the loan that makes you feel right at home. Not all mortgages are created equal. Let our experienced lenders help you sort through the financing options! Explore the solutions below to begin your journey:

Current Homebuyer Incentives

New Construction Home Benefit*

Receive benefits on your long-term financing for your new build. Get up to $8,327.50 or a 1% discount when you finance with FCB! You can apply this benefit to help with any of the following:

- Closing costs

- Prepaid items

- Permanent interest rate buy down

- Temporary interest rate buy down

Relationship Pricing**

Receive a mortgage discount in the form of point reductions to reduce interest rate or closing costs when you develop a deposit relationship with First Community Bank. We offer the following benefits:

Checking Account Discount | Receive a 0.25% points discount with any FCB Checking Account and auto-pay of new mortgage

Deposit Relationship Discounts | Receive a 0.25% points discounts for deposit balances in a FCB account.

The Checking and Deposit Relationship Discounts can be combined (ex. Checking Account discount of 0.25% plus $100,000 plus in deposits of 0.25% equal a total discount of 0.50% in points).

Veteran's Program

Creating homeownership for those who serve! Get up to $8,327.50 or a 1% discount when you finance with FCB! You can apply this benefit to help with any of the following:

- Closing Costs

- Prepaid Items

- Interest Rate Buydown (Permanent or Temporary)

Promotion ends 6/1/2026.

We offer product types for every need.

Purchase Loans

We have solutions for First-time Homebuyers, existing home buyers, second homes, and investors. Start today by getting a pre-approved and help with piece of mind on qualifying, before you shop for a new home!

Refinances Loan Options

Use your home’s equity to lower monthly payments, consolidate debt, or access cash for other financial goals.

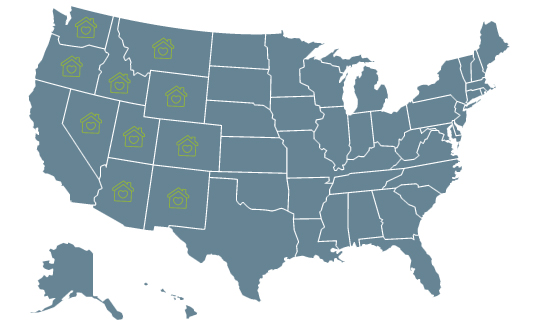

Did you know we offer mortgage solutions in 10 states?

*New Construction Home Benefit and VA Program | Offer valid for up to $8,327.50 or 1% of loan amount, whichever is smaller. Available with First Community Bank secondary market conventional, Jumbo, FHA, and VA Loans up to $832,750.

Offer only valid for costs described and cannot be used to decrease loan amount. Not valid with custom construction or any other promotion. Loan must close with First Community Bank. Employees are not eligible for builder promotion. All loan decisions are subject to First Community Bank's internal lending constraints and the unique credit circumstances of the borrower.

**Relationship Pricing Benefit can be applied to any mortgage product with the exception of 12 Month Construction only loans. The program can be applied to the permanent loan. The new account and deposits must be established and in the account, verified by underwriting, before the discount can be applied to the loan and disclosed.

The program cannot be combined with any other mortgage promotion and is subject to change at the discretion of First Community Bank. Employees are not eligible for builder promotion. All loan decisions are subject to First Community Bank's internal lending constraints and the unique credit circumstances of the borrower.